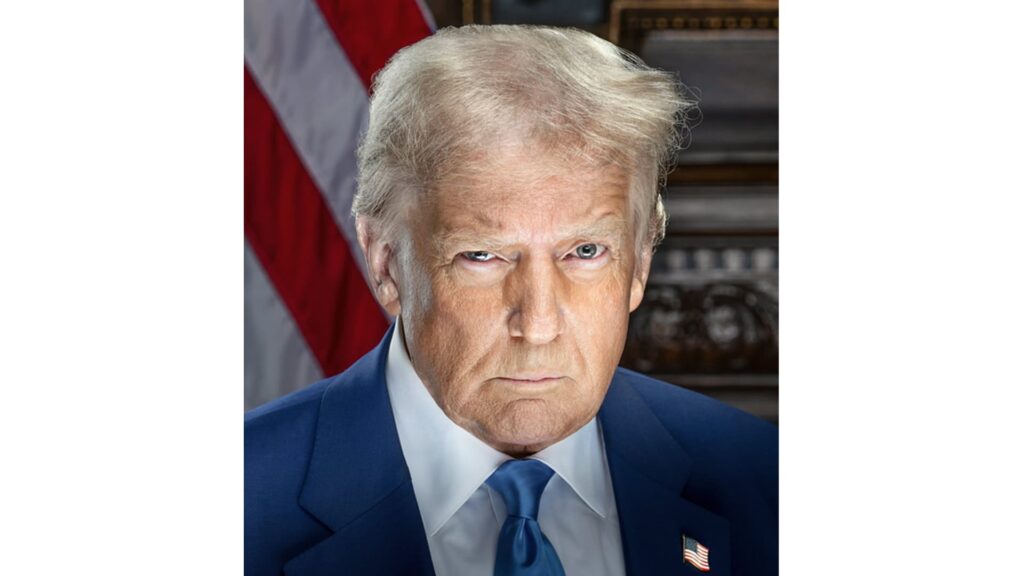

On April 2, 2025, President Donald Trump announced a series of sweeping tariffs, referred to as “Liberation Day” tariffs, aimed at addressing trade imbalances and promoting economic independence. The policy includes a universal 10% tariff on all imports, effective April 5, with additional higher tariffs targeting specific countries with significant trade surpluses with the U.S. For example, China faces an additional 34% tariff, totaling 54%, while the European Union is subjected to a 20% tariff.

Market Reactions:

- Stock Markets: Following the announcement, global markets experienced significant volatility. Wall Street futures plunged, with the Dow Jones Industrial Average futures dropping 2.86%, S&P 500 futures falling 3.6%, and Nasdaq 100 futures declining by 4.2%. Tech companies with international supply chains, such as Apple and Tesla, saw substantial premarket losses.

- Oil Prices: Oil prices slumped over 6% amid concerns that the tariffs could dampen global economic growth and reduce demand.

International Responses:

The tariffs have elicited strong reactions from U.S. trading partners. China and the European Union have vowed to implement countermeasures, raising fears of an escalating trade war. European Commission President Ursula von der Leyen criticized the move, stating it could have dire consequences for the global economy.

Economic Implications:

Analysts warn that these tariffs could increase the risk of a global recession or stagflation. The U.S. dollar has also experienced a sharp decline, prompting concerns about a potential confidence crisis in the currency.

Please note that the situation is rapidly evolving. For the most current information, refer to reputable news sources.